Blog Layout

In the Middle of a 10 Year Term? You Have Options!

Garibaldi Mortgage • Dec 18, 2019

If you bought a house, or had a mortgage renew roughly five years ago, there's a chance the struggling economy and the relatively low interest rate environment (at the time) influenced you to "play it safe" and lock in a mortgage term for the next ten years. Because, at the time, it seemed like interest rates couldn't go any lower and the difference in the interest rate between the five year fixed term, and the ten year fixed was negligible. Five years extra security made a lot of sense.

Without the benefit of a crystal ball, this looked like a good decision. However, unfortunately as interest rates have dropped even further, you're probably now stuck in a mortgage with a rate that is higher than what is currently being offered on the market. If you are second guessing your original decision. Don't. You made a decision based on the information you had at the time, if rates would've gone up, you'd be in a great place now. But, as that isn't the case, the best we can do is look for a silver lining, and here it is, did you know that there is a mandatory fine print clause in your ten year contract that might help you save money over the next five years?

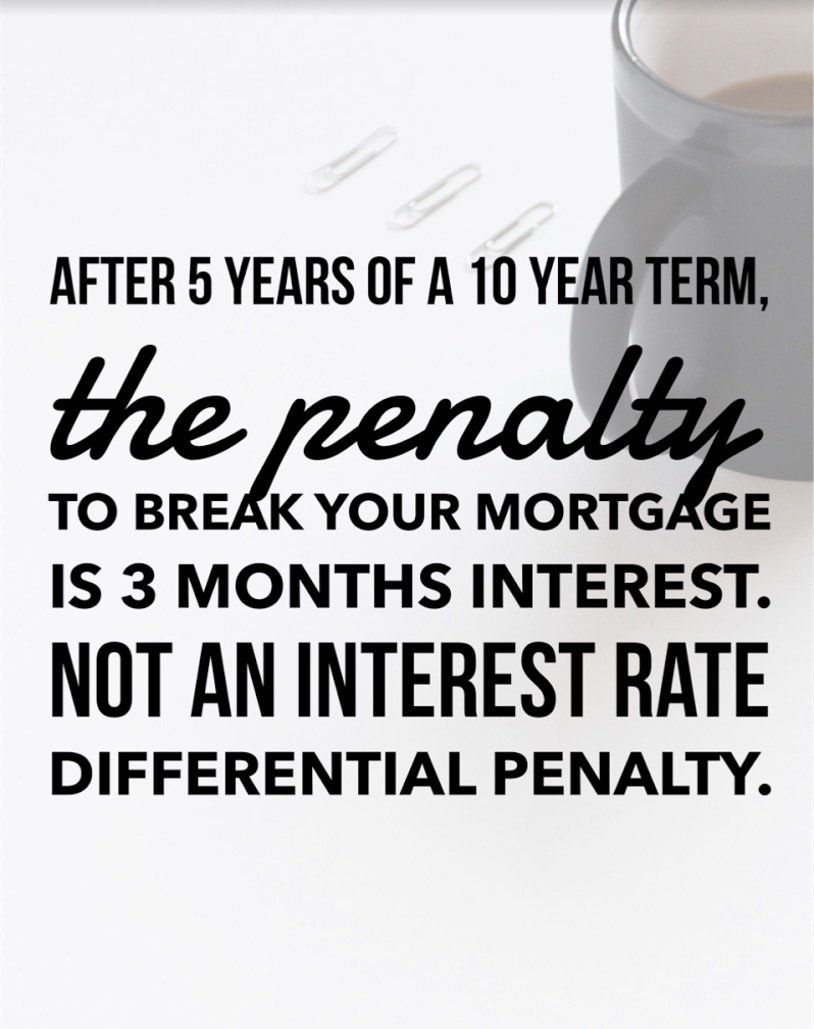

After the first five years of a ten year term has been completed, the penalty to break the mortgage is three months interest, instead of the interest rate differential penalty. That's a really big deal!

It doesn't matter which lender you are with, this is actually a law in Canada, and not conditional upon the contract you signed with your lender. So, if the thought of an outrageous penalty has been keeping you from looking at all your options, you should really check out what is available on the market today.

Interest rates are really low, so low in fact that there's a chance you can switch out of your ten year rate into another mortgage product at a lower rate and not only cover the cost of the three month interest penalty, but actually be further ahead only a couple years into your new term. The real goal is to save thousands of dollars by switching, and that is very possible!

As each person's financial situation is different, rather than going through a hypothetical situation where we explain how this all works for hypothetical people, if you have made it this far, chances are this applies to you. You should really reach out and contact us to see about all your options, because you have options!.

There's no cost for our services, so let's see how much money you can save over the next five years!

By Garibaldi Mortgage

•

23 Jun, 2021

Buying a property might actually be easier than you think. So, if you have NO desire AT ALL to qualify for a mortgage, here are some great steps you can take to ensure you don’t accidentally buy a property. Fair warning, this article might get a little cheeky. Quit your job. First things first, ditch that job. One of the best ways to make sure you won’t qualify for a mortgage is to be unemployed. Yep, most mortgage lenders aren’t in the practice of lending money to unemployed people! If you already have a preapproval in place and don’t want to go through with financing, no problems. Unexpectedly quit your job mid-application. Because, even if you’re making a lateral move or taking a better job, any change in employment status can negatively impact your approval. Spend All Your Savings. To get a mortgage, you’ll have to bring some money to the table. In Canada, the minimum downpayment required is 5% of the purchase price. Now, if the goal is not to get a mortgage, spending all your money and having absolutely nothing in your account is a surefire way to ensure you won’t qualify for a mortgage. So, if you’ve been looking for a reason to go out and buy a new vehicle, consider this your permission. Collect as Much Debt as Possible. After quitting your job and spending all your savings, you should definitely go out and incur as much debt as possible! The higher the payments, the better. You see, one of the main qualifiers on a mortgage is called your debt-service ratio. This takes into count the amount of money you make compared to the amount of money you owe. So the more debt you have, the less money you’ll have leftover to finance a home. Stop Making Your Debt Payments So let’s say you can’t shake your job, you still have a good amount of money in the bank, and you’ve run out of ways to spend money you don’t have. Don’t panic; you can still absolutely wreck your chances of qualifying for a mortgage! Just don’t pay any of your bills on time or stop making your payments altogether. Why would any lender want to lend you money when you have a track record of not paying back any of the money you’ve already borrowed? Provide Ugly Supporting Documentation. Now, if all else fails, the last chance you have to scuttle your chances of getting a mortgage is to provide the lender with really ugly documents. To support your mortgage application, lenders must complete their due diligence. Here are three ways to make sure the lender won’t be able to verify anything. Firstly, and probably the most straightforward, make sure your name doesn’t appear anywhere on any of your statements. This way, the lender can’t be sure the documents are actually yours or not. Secondly, when providing bank statements to prove downpayment funds, make sure there are multiple cash deposits over $1000 without explaining where the money came from. This will look like money laundering and will throw up all kinds of red flags. And lastly, consider blacking out all your “personal information.” Just use a black Sharpie and make your paperwork look like classified FBI documents. Follow-Through So there you have it, to avoid an accidental home purchase, you should quit your job, spend all your money, borrow as much money as possible, stop making your payments, and make sure the lender can’t prove anything! This will ensure no one will lend you money to buy a property! Now, on the off chance that you’d actually like to qualify for a mortgage, you’ve come to the right place. The suggestion would be to actually keep your job, save for a downpayment, limit the amount of debt you carry, make your payments on time, and provide clear documentation to support your mortgage application! If you'd like to make sure you're on the right track, connect anytime. It would be a pleasure to walk through the mortgage process with you.

By Garibaldi Mortgage

•

16 Jun, 2021

If you’re looking to buy a property or have a mortgage up for renewal, and you’re thinking about connecting with your bank directly, save yourself a lot of money and regret by reading this article first. Here are four things that your bank won’t tell you, accompanied by four reasons that explain why working with an independent mortgage professional is in your best interest. Banks have Limited Access to Mortgage Products. Now, while this one may seem pretty straightforward, if you’re dealing with a single institution, they can only offer mortgages from their product catalogue. This means that you’ll be restricted to their qualifications which are usually very narrow. Working with a single institution significantly limits your options, especially if your financial situation isn’t straightforward. In contrast, dealing with an independent mortgage professional, you will have access to products from over 200 lenders, including banks, monoline lenders, credit unions, finance companies, alternative lenders, institutional B lenders, Mortgage Investment Corporations, and private funds. Working with an independent mortgage professional will give you considerably more options to secure a better mortgage. Banks Employ Salespeople, not Mortgage Experts. Banks don’t employ mortgage experts; they employ salespeople. Banks pay and incentivize salespeople to sell their products. There is a fundamental misalignment of values here. If the bank incentivizes a banker to make a profit for the bank, how can they at the same time advocate for you and your best interest? They can’t. Banks don’t have your best interest in mind. In fact, the more money they make off of you, the better it is for their bottom line. However, when you work with an independent mortgage professional, you get the experience of someone who understands the intricacies of mortgage financing and will advocate on your behalf to get you the best mortgage. It’s actually in our best interest to assist you in finding the mortgage with the best terms for you. Once your mortgage completes, we get paid a standardized finder’s fee by the lender for arranging the financing. So although we get paid by the lender, that lender has had to compete with other lenders to earn your business. When you work with an independent mortgage professional, everyone wins. You get the best mortgage available, we get paid a standardized finder’s fee, and the lender gets a new borrower. Banks Rarely Offer You Their Best Terms Upfront. Banks are in the business of making money, and they’re usually pretty good at it. As such, banks will rarely offer you their best terms at the outset of your negotiation. This is especially true if you’re looking to refinance your existing mortgage. With over half of Canadians simply accepting the renewal offer they get sent in the mail without question, banks don’t have to put their best rate forward. Instead, they rely on you to be ignorant of the process and will take advantage of your trust in them. When you work with an independent mortgage professional, we don’t play games with rates and terms. Our goal is always to seek out the lender who has the best mortgage for you from the start of the process, and if there are any negotiations to be had, we handle them for you. There is no reason for us to do otherwise. In fact, the better we do our job, the more likely it is that you’ll be happy with our services and refer your friends and family. Banks Promote Restrictive Mortgage Products. As if it’s not bad enough that banks don’t offer their best terms upfront, they actually promote mortgage products that are restrictive in nature. The fine print in your mortgage contract matters; understanding it is challenging. Banks do what they can to make it hard for you to leave. Now, if you’ve ever heard stories of outrageous penalties being charged, this is what’s called an Interest Rate Differential penalty (IRD). Each lender has its own way of calculating the IRD. Chartered banks are known for their restrictive mortgages and high IRD penalties. When you work with an independent mortgage professional, we take the time to listen to your goals and assess your mortgage needs based on your life circumstances. The best mortgage is the one that lowers your overall cost of borrowing. So not only will we walk through the cost of the mortgage financing, but we’ll also clearly outline the costs incurred should you need to break your mortgage before the end of your term. This might be the deciding factor in choosing the right lender and mortgage for you. Working with an Independent Mortgage Professional is in Your Best Interest. Banks have limitations to the mortgage products they offer. Working with an independent mortgage professional gives you mortgage options! Bankers work for the bank; they are incentivized to make money for the bank. An independent mortgage professional advocates on your behalf to get you the best mortgage available. Banks rarely offer their best terms upfront; they leave negotiations up to you. An independent mortgage professional outlines the best terms from multiple lenders at the start of the process. Banks promote restrictive mortgage products that make it difficult to leave them. An independent mortgage broker will outline all the costs associated with different mortgage products and recommend the mortgage best suited for your needs. So if you’d like to talk about the best mortgage product for you, you’ve come to the right place. Please connect anytime. It would be a pleasure to work with you.

By Garibaldi Mortgage

•

09 Jun, 2021

Bank of Canada will hold current level of policy rate until inflation objective is sustainably achieved, continues quantitative easing The Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent, with the Bank Rate at ½ percent and the deposit rate at ¼ percent. The Bank is maintaining its extraordinary forward guidance on the path for the overnight rate. This is reinforced and supplemented by the Bank’s quantitative easing (QE) program, which continues at a target pace of $3 billion per week. With COVID-19 cases falling in many countries and vaccine coverage rising, global economic activity is picking up. Growth remains uneven across regions, however. The US is experiencing a strong consumer-driven recovery and a rebound is beginning to take shape in Europe, while a resurgence of the virus is hampering the recovery in some emerging market economies. Financial conditions remain highly accommodative, reflected in broadly higher asset prices. Commodity prices have risen further, notably oil, and the Canadian dollar has seen a further appreciation. In Canada, economic developments have been broadly in line with the outlook in the April Monetary Policy Report (MPR). Despite the second wave of the virus, first quarter GDP growth came in at a robust 5.6 per cent. While this was lower than the Bank had projected, the underlying details indicate rising confidence and resilient demand. Household spending was stronger than expected, while businesses drew down inventories and increased imports more than anticipated. Renewed lockdowns associated with the third wave are dampening economic activity in the second quarter, largely as anticipated. Recent jobs data show that workers in contact-sensitive sectors have once again been most affected. The employment rate remains well below its pre-pandemic level, with low wage workers, youth and women continuing to bear the brunt of job losses. With vaccinations proceeding at a faster pace, and provincial containment restrictions on an easing path over the summer, the Canadian economy is expected to rebound strongly, led by consumer spending. Housing market activity is expected to moderate but remain elevated. Strong growth in foreign demand and higher commodity prices should also lead to a solid recovery in exports and business investment. Despite progress on vaccinations, there continues to be uncertainty about the evolution of new COVID-19 variants. More broadly, the risks to the inflation outlook identified in the April MPR remain relevant. As expected, CPI inflation has risen to around the top of the 1-3 percent inflation-control range, due largely to base-year effects and much stronger gasoline prices. Core measures of inflation have also risen, due primarily to temporary factors and base year effects, but by much less than CPI inflation. While CPI inflation will likely remain near 3 percent through the summer, it is expected to ease later in the year, as base-year effects diminish and excess capacity continues to exert downward pressure. The Governing Council judges that there remains considerable excess capacity in the Canadian economy, and that the recovery continues to require extraordinary monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s April projection, this happens sometime in the second half of 2022. The Bank is continuing its QE program to reinforce this commitment and keep interest rates low across the yield curve. Decisions regarding adjustments to the pace of net bond purchases will be guided by Governing Council’s ongoing assessment of the strength and durability of the recovery. We will continue to provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation objective. Information note The next scheduled date for announcing the overnight rate target is July 14, 2021. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

CONTACT US

Del – 250-212-1142

ABOUT

APPLY NOW

© 2024

All Rights Reserved | Garibaldi Mortgage